MINT and Smart Tokens

MINT is a non-inflationary BEP20 based token on the Binance Smart Chain used for collateral assets in Mint Club.

Mint Club is one of the DApps on the HUNT Platform, so MINT token was ONLY minted by swapping HUNT token during the pre-sign up period. MINT token follows the fair launch spirit, so there was NO token sale, no investors, and no free team allocation. Check how the pre-sign up was performed below:

Pre-sign Up (finished)MINT total supply

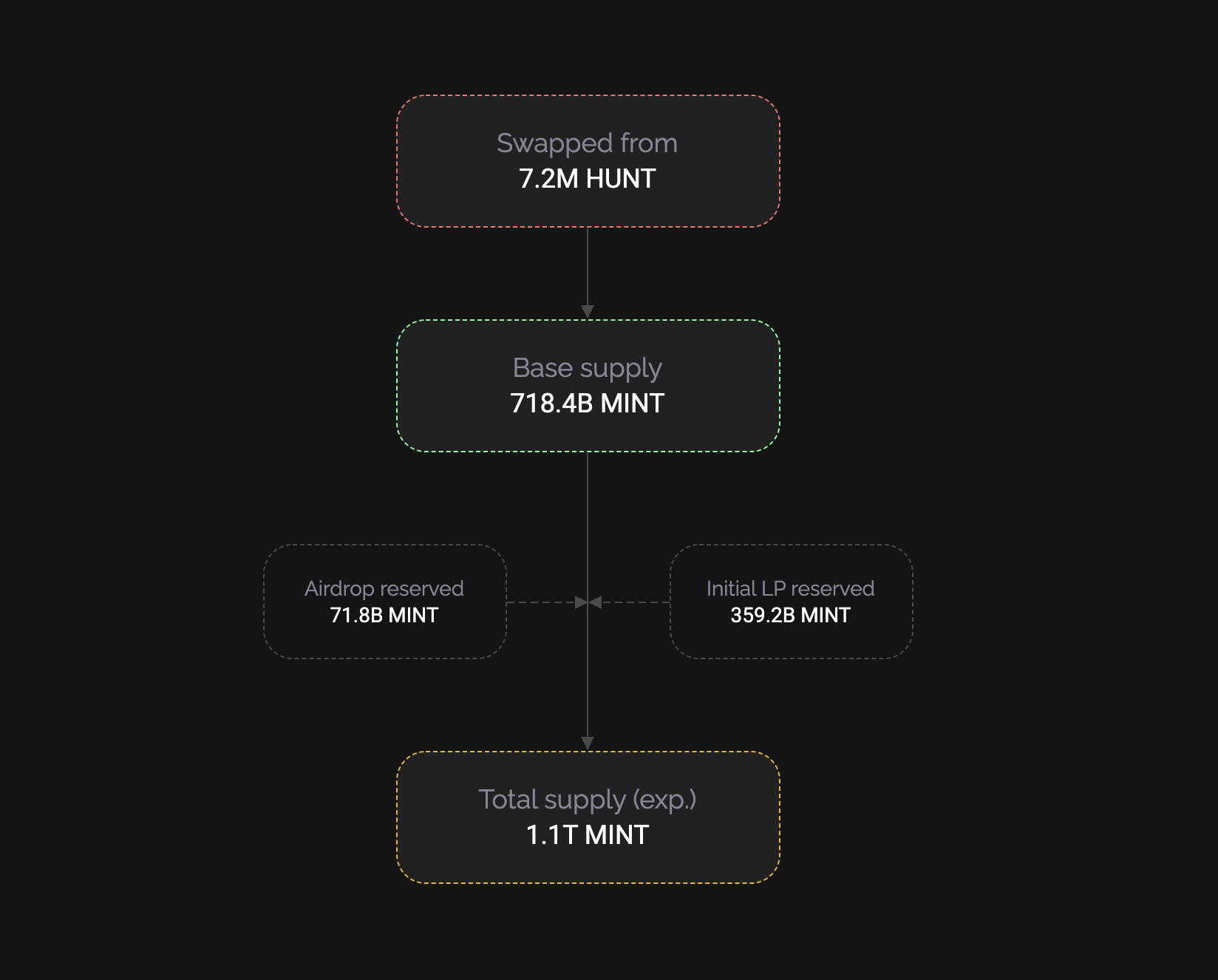

MINT token is a non-inflationary token, which means that there will be no further minting once the initial supply has been set. Total MINT supply is 1,149,363,840,000 MINT and this supply was determined by the following categories during the pre-sign up period:

Categories

Description

Amount

1. HUNT → MINT Swap

HUNT holders swapped their tokens to MINT tokens, and this became the `base supply`.

718,352,400,000 MINT

2. Community airdrop

10% of the base supply was additionally allocated for the community.

71,835,240,000 MINT

3. Initial LP and business development fund

The team also swapped their HUNT to MINT tokens with 50% of the base supply.

359,176,200,000 MINT

Total

1,149,363,840,000 MINT

MINT Token Utility for Smart Tokens

MINT token works as a key currency to fuel smart tokens on Mint.club via the bonding curve-backed smart contracts.

Smart tokens are BEP20 tokens created via the Mint Club protocol. Unlike other tokens, smart tokens are natively liquid, powered by MINT collateral smart contract, so anyone can trade the tokens without any trading pairs of liquidity pools.

Smart Token Bonding CurveThis mechanism is possible due to the bonding curve and MINT collateral contracts as below:

All smart tokens have a built-in price bonding curve that provides a pre-set price on each token supply.

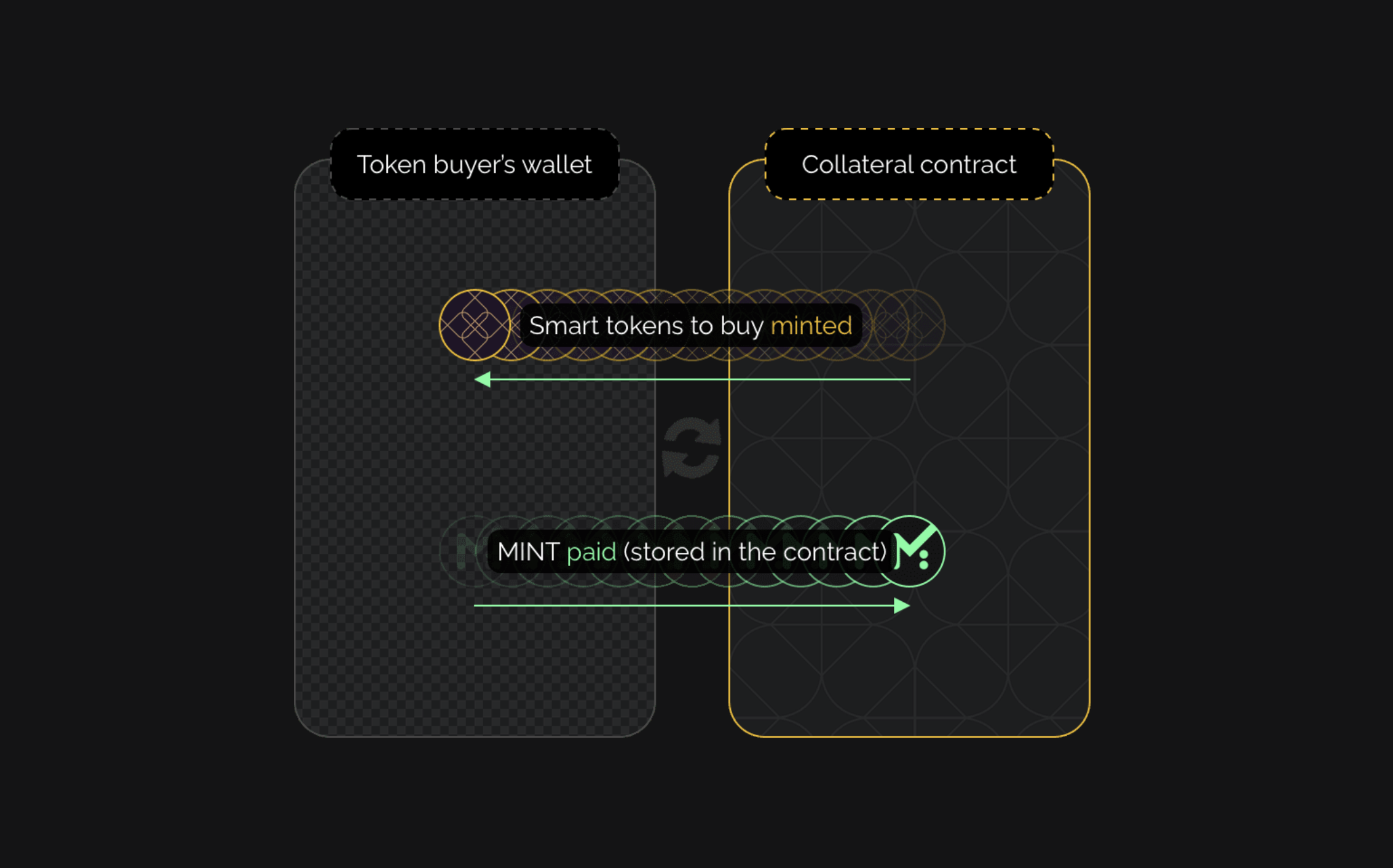

When a smart token is purchased, the price bonding curve calculates the amount of MINT to be paid and swapped between them. The paid MINT tokens are stored on the collateral contract of the smart token, and the amount of smart tokens are minted to the buyer in return.

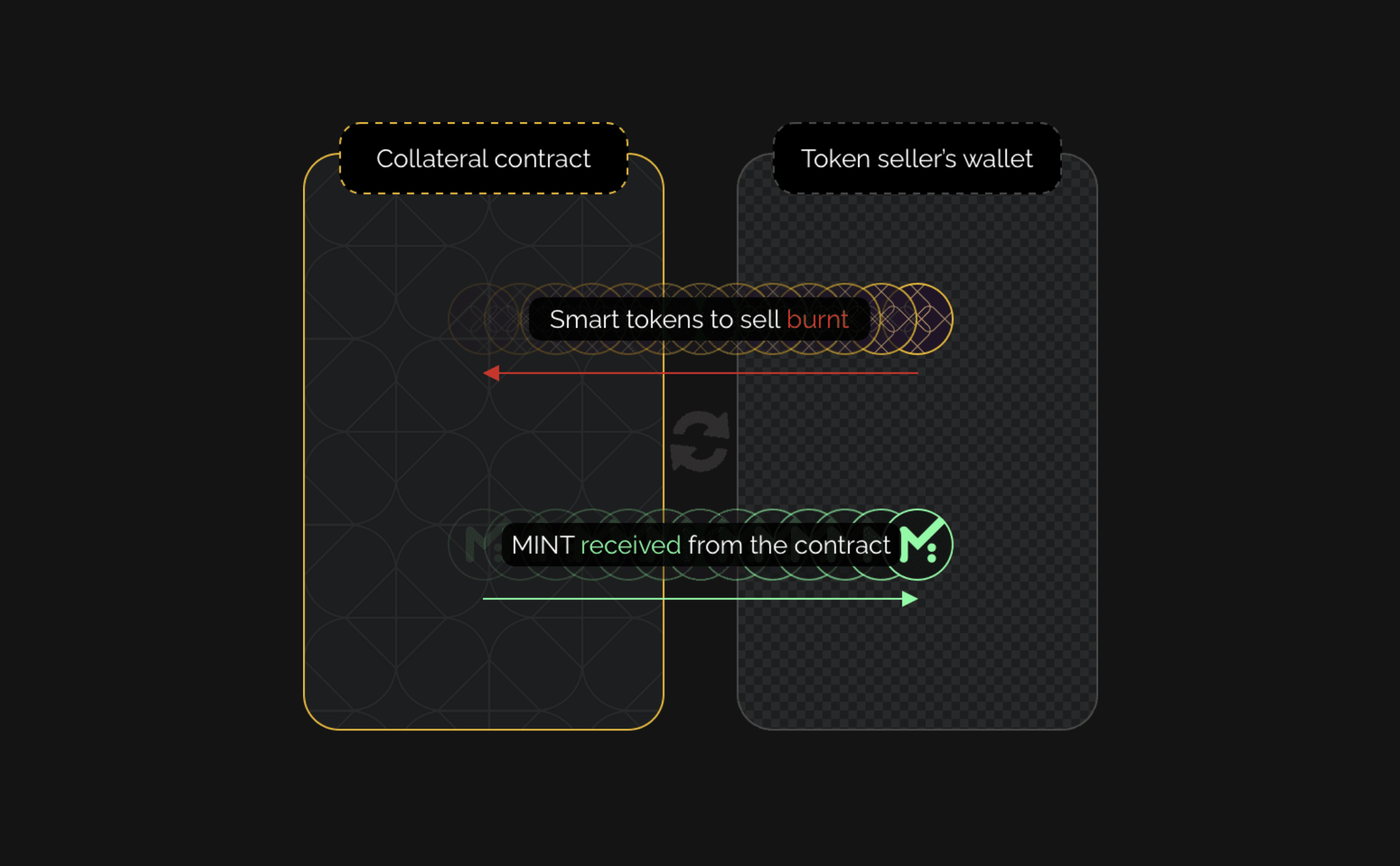

When a smart token is sold, the price bonding curve calculates the amount of MINT to be given, and swapped between them by returning the MINT tokens to the seller and burning the sold smart tokens.

By following this method, the total supply of the smart tokens keeps increasing or decreasing whenever people buy or sell the tokens.

Let’s deep dive with an example. Imagine that someone has just created a KITTY coin on Mint Club with the max supply of 100,000, and the creator purchased 1,000 instantly. After that, you try to purchase 100 KITTY tokens with the following steps:

100 KITTY tokens are newly minted to your wallet by the contract and each unit price is set according to the price bonding curve.

The amount of MINT tokens required to pay is calculated by the bonding curve, and they are transferred from your wallet to the collateral contract in return.

The MINT tokens paid by you are kept in the contract as a collateral asset to back the market cap of the smart token.

Now, the total supply of KITTY becomes 1,100 KITTY (1,000 + 100) with 11% circulating supply.

Now imagine that you’re not confident with what the KITTY token creator is trying to build, so you have decided to sell half of your KITTY tokens by following the steps as below:

50 KITTY are taken away from your wallet and burnt. Each unit cost is set according to the price bonding curve.

The amount of MINT tokens you are required to receive is calculated by the bonding curve and then transferred from the collateral contract to your wallet in return.

Now, the total supply of KITTY has been reduced to 1,050 KITTY with 10.5% circulating supply.